11th May 2024

The Aadhar Housing Finance IPO is a book-built issuance worth Rs 3,000.00 crore. The offering consists of a fresh issue of 3.17 crore shares worth Rs 1,000.00 crore and an offer for sale of 6.35 crore shares worth Rs 2,000.00 crore.

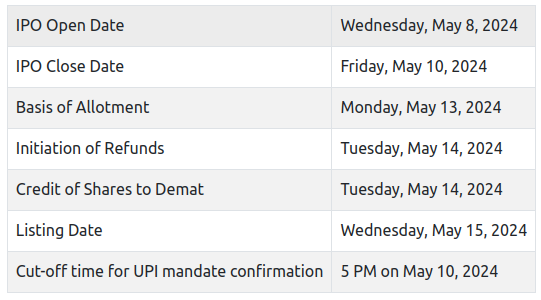

The Aadhar Housing Finance IPO bidding started on May 8, 2024, and finished on May 10, 2024. The allotment for the Aadhar Housing Finance IPO is expected to be completed on Monday, May 13, 2024. Aadhar Housing Finance IPO will be listed on the BSE and NSE, with a tentative date of Wednesday, May 15, 2024.

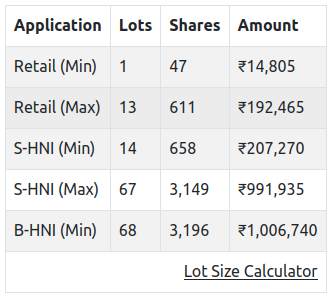

Aadhar Housing Finance IPO pricing range is ₹300-315 per share. The minimum lot size for an application is 47 shares. The minimum investment for retail investors is ₹14,805. The minimum lot size investment for sNII is 14 lots (658 shares) for ₹207,270, while for bNII, it is 68 lots (3,196 shares) worth ₹1,006,740.

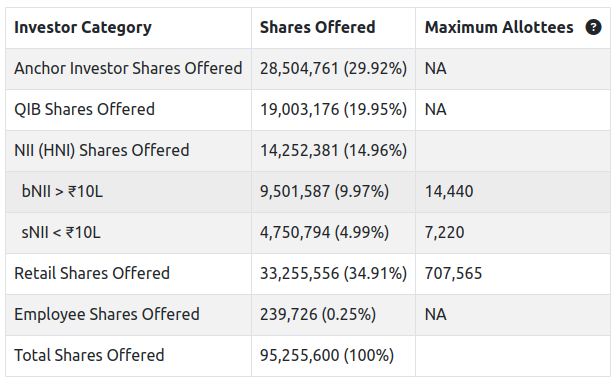

The issuance includes a reservation of up to 239,726 shares for employees, which are provided at a discount of Rs 23 from the issue price.

ICICI Securities Limited, Citigroup Global Markets India Private Limited, Kotak Mahindra Capital Company Limited, Nomura Financial Advisory And Securities (India) Pvt Ltd, and SBI Capital Markets Limited are the book-running lead managers for the Aadhar Housing Finance IPO.Aadhar Housing Finance IPO Review

BP Equities, an established financial firm, has assigned subscribe rating to the Aadhar Housing Finance IPO. They believe the company is fairly priced in comparison to its peers, with a P/BVPS of 3.1x on FY23 book value. They advocate subscribing to the issue based on its valuation. This positive review contributes to the general positive sentiment around the IPO.

Marwadi Shares and Finance advises investors to apply for the public issue, stating that the company’s post-issue Book Value of ₹52,492 mn will be listed at a P/B of 2.56x, with a market cap of Rs. 1,34,348 mn. Its peers, Aptus Value Housing Finance India Limited, Aavas Financiers Limited, Home First Finance Company India Limited, and India Shelter Finance Corporation Limited, are trading at a P/B of 4.65x, 3.36x, 4.05x, and 4.59x, respectively. We rate this IPO “Subscribe” because the company has a well-established business model with excellent resilience through business cycles and comprehensive processes for underwriting, collections, and asset quality monitoring. Furthermore, it is available at an acceptable valuation when compared to its peers.”

Aadhar Housing Finance IPO Details

Aadhar Housing Finance IPO Timeline (Tentative Schedule)

The Aadhar Housing Finance IPO begins on May 8, 2024 and ends on May 10, 2024.

Aadhar Housing Finance IPO Lot Size

Investors may bid for a minimum of 47 shares or multiples thereof. The table below shows the lowest and maximum investment by retail investors and high-net-worth in terms of shares and amounts.

Aadhar Housing Finance IPO Reservation

The Aadhar Housing Finance IPO includes 95,255,600 shares. 19,003,176 (19.95%) to QIB; 14,252,381 (14.96%) to NII; 33,255,556 (34.91%) to RII; 239,726 (0.25%) to workers; and 28,504,761 (29.92%) to Anchor investors. 707,565 RIIs will receive a minimum of 47 shares, while 7,220 (sNII) and 14,440 (bNII) will receive at least 658 shares. (In case of oversubscription)

Aadhar Housing Finance IPO Promoters Holding

The Company’s promoter is BCP Topco VII Pte Ltd.

Details about the Aadhar Housing Finance IPO’s anchor investors

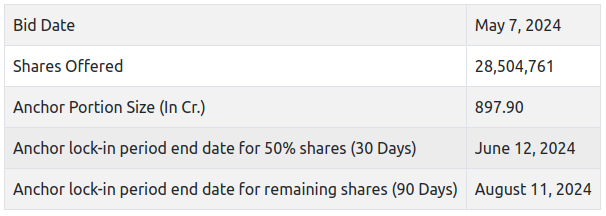

Anchor investors contribute Rs 897.90 crore to Aadhar Housing Finance’s initial public offering. The Aadhar Housing Finance IPO’s anchor bid date is May 7, 2024. Aadhar Housing Finance IPO Anchor Investors list.

Aadhar Housing Finance IPO FAQs

1. What is the Aadhar Housing Finance IPO?

The Aadhar Housing Finance IPO is a main-board offering of 95,238,095 equity shares with a face value of ₹10, worth up to ₹3,000.00 crore. The issue is priced at ₹300-315 per share. The minimum order quantity is 47 shares.

The IPO begins on May 8, 2024 and ends on May 10, 2024.

The registrar for the first public offering is Kfin Technologies Limited. The shares are proposed to be listed on the BSE and NSE.

2. How to apply for the Aadhar Housing Finance IPO using Zerodha?

Zerodha users can apply online for the Aadhar Housing Finance IPO using UPI as a payment method. Zerodha users can apply for the Aadhar Housing Finance IPO by logging into the Zerodha Console (back office) and completing the IPO application form.

Steps to apply for the Aadhar Housing Finance IPO through Zerodha.

Visit the Zerodha website and log in to Console. Go to Portfolio and select the IPOs link. Navigate to the 'Aadhar Housing Finance IPO' row and hit the 'Bid' button. Please enter your UPI ID, quantity, and price. Submit the IPO application form. To approve the mandate, go to the UPI App (Net Banking or BHIM).

Visit Zerodha IPO Application Process Review for more detail.

3. How to apply for Aadhar Housing Finance IPO?

You can apply in Aadhar Housing Finance IPO online using either UPI or ASBA as payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don’t offer banking services. Read more detail about apply IPO online through Zerodha, Upstox, 5Paisa, Nuvama, ICICI Bank, HDFC Bank and SBI Bank.

4. When is Aadhar Housing Finance IPO allotment?

The finalization of Basis of Allotment for Aadhar Housing Finance IPO will be done on Monday, May 13, 2024, and the allotted shares will be credited to your demat account by Tuesday, May 14, 2024. Check the Aadhar Housing Finance IPO allotment status.

5. When is Aadhar Housing Finance IPO listing date?

The finalization of Basis of Allotment for Aadhar Housing Finance IPO will be done on Monday, May 13, 2024, and the allotted shares will be credited to your demat account by Tuesday, May 14, 2024. Check the Aadhar Housing Finance IPO allotment status.

Visit for more articles like this: https://trendsoftgrow.com/