Finance Reporter 10th May, 2024

Why sells Citigroup Vodafone Idea shares?

Citigroup, a financial services company, sold shares of Vodafone Idea in an open market transaction worth more than Rs 233 crore on Wednesday.

Citigroup, located in the United States, sold Vodafone Idea shares in a block trade on the BSE through its affiliate, Citigroup Global Markets India.

Citigroup, located in the United States, sold Vodafone Idea shares in a block Deal trade on the BSE through its affiliate, Citigroup Global Markets India.

Citigroup Global Markets Mauritius Pvt Ltd sold 19,04,25,000 Vodafone Idea shares, according to BSE data.

The shares were sold for an average price of Rs 12.27 each, taking the total transaction value to Rs 233.65 crore.

Meanwhile, Ghisallo Master Fund LP acquired Vodafone Idea shares at the same price.

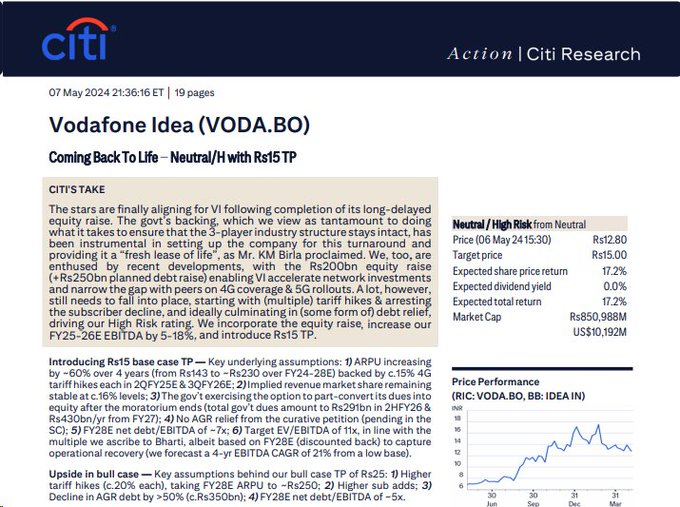

CITI report on – Vodafone Idea

With Neutral Rating

TP Rs 15 (Bull case TP Rs 25)

Foreign Brokerage Citi said the stars are now aligning for Vodafone Idea Ltd, which has completed its long-delayed equity raise. Citi said in its most recent note that the government’s support, which it sees as important in preserving the three-player industry structure, will remain intact. It has been critical in preparing the company for a recovery and a “fresh lease of life,” as KM Birla stated, according to a tweet on X. Business Today was unable to independently authenticate the report.

“We, too, are excited by recent developments, with the Rs200 billion equity raise (+Rs250 billion planned debt raise) allowing VI to accelerate network investments and close the gap with peers on 4G coverage and 5G rollouts.” A lot still needs to fall into place, beginning with (several) tariff hikes and stopping subscriber drop, and ideally ending in (some form of) debt relief, resulting in a ‘High Risk’ rating.

Citi said it incorporated the equity raise and raised its FY25-26 EBITDA estimates by 5-18%, setting a base case target price of Rs 15 for Vodafone Idea.

The stars are finally aligning for Vodafone Idea, according to global trading group Citi Research. Following a nearly 87 percent increase in Vodafone Idea over the last year, the brokerage expects another nearly 100 percent potential upside in the telecom stock in its bull case scenario.

“The stars are finally aligning for VI following the completion of its long-awaited stock raise. The government’s support, which we see as equal to doing all it takes to keep the three-player industry structure intact, has been important in preparing the company for this turnaround and giving it a “new lease on life,” as KM Birla declared. Citi is excited by recent developments, with the ₹20,000 crore equity raise (above ₹25,000 crore planned debt raise) enabling VI to accelerate network investments and shrink the gap with peers in terms of 4G coverage and 5G rollouts.

Mumbai: Citigroup sold Vodafone Idea shares for over 234 crore in open market transactions on Wednesday. Citigroup, located in the United States, sold Vodafone Idea shares in a block trade on the BSE through its affiliate, Citigroup Global Markets Mauritius. Citigroup Global Markets Mauritius sold 19,04,25,000 shares of Vodafone Idea, according to BSE data. The shares were sold for an average price of 12.27 per, totaling 233.65 crore.

Furthermore, Citi stated that management is optimistic that the industry will implement tariff increases sooner rather than later following the June 2024 election results, which it feels are necessary given considerable network and spectrum investments. Aside from rate increases, ARPUs should benefit from upgrading 2G subscribers to 4G, as 42 percent of VI clients are not yet on 4G (compared to 29 percent for Bharti).

Visit for more articles like this: https://trendsoftgrow.com/